08 Aug The UK Consumer’s Payments Persona

With the cost of living crisis and economic uncertainty continuing to be a major concern for businesses and their customers, it’s more important than ever to have a clear understanding of how UK consumers view, and interact with, their personal finances and payments.

Our recent survey, The Attitudes of Europeans to Payments Methods, conducted by EVO Payments in the UK and 13 other countries, offers rich insight into the payment behaviours and habits of consumers. The survey also offers a country to country comparison.

We delve behind the statistics from the survey to gain a better sense of the average shopper’s payment persona as well as the growing importance for businesses to offer cashless payment solutions.

Almost half of consumers either feel they have control over their expenses or don’t like to spend their money quickly

British customers, on the whole, control their expenses with the majority being aware of how much money is in there bank account/s or wallet.

Our findings reveal a consumer base where a large segment are not overly impulsive in their spending habits and almost two thirds of consumers dislike thinking about or dealing with money.

A large group (29%) feel they have they control over their money and expenses while the second largest grouping (17%) don’t like to spend their money quickly. Both groups dislike thinking about money or having to deal with it.

In fact, only 14% of consumers surveyed fit within a category that consciously consider how they manage their money and invest / save for the future.

These findings paint a picture of a customer base whose approach to viewing and controlling personal finance is often based on the principle of using their finances as a means to gain value through their purchases rather than using their money to expand their wealth through investments.

From a merchant’s perspective this is promising provided the value of a product and/ or service is clear and targeted at the correct target audience.

98% of British shoppers use digital payment options

Only 2% of British people do not use digital payments – half the survey’s average of 4%. The survey also found them more aware of what payment options were available to them than in any other countries too.

Undoubtedly The UK has been a major adopter of digital payments coming out as a market leader for their preference for non-cash based payments in-stores with 71% opting for card, contactless and wearable devices when paying. This is 15% higher than the survey’s average.

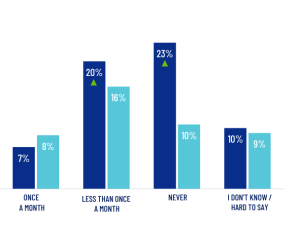

In fact, when offered several payment choices to complete a purchase, 50% of shoppers would only choose to pay with cash around once a month, less, with only 1 in 5 choosing to pay with cash up to 2 to 3 times a week.

Percentage of UK consumers (in dark blue) who opt to use cash when other forms of payment options are available compared to the survey’s average (in light blue).

Only 6% of shoppers will opt for cash for big ticket purchases (over £1,000)

Our survey offers a more granular breakdown into what particular situations UK shoppers prefer making payments. The cost of the transaction influences how shoppers pay too, with a clear preference given for electronic payments when purchasing more expensive items.

While people are more inclined to pay with cash for small purchases, card and wearable devices grew in popularity as the price of the purchase increases, as demonstrated in the graphs below.

When we break it into sectors and scenarios, electronic payments wins out over cash in all scenarios with the exception of two – shopping at markets and gift giving (weddings, birthdays etc.). Almost half will opt for card when doing regular grocery shopping with about 4 in 10 using either cash or electronic payments.

71% of shoppers perceive places offering electronic payments as customer-centric

Unsurprisingly, the vast majority of British people believe there are more places where you can pay with a card, phone or other devices after the COVID-19 pandemic.

How consumers perceive payments also now impacts how they view your business. 8 out of 10 UK customers perceive places offering electronic payments as modern with 71% believe businesses with alternative payment options as being customer-centric.

Electronic payments by card, telephone or other devices have a much better perception in the UK than cash. The most important features that distinguishes electronic payment methods from paper-based alternatives are innovation, time saving and security. Cash, as in other countries, is most strongly associated with reliability and spending control.

On the whole, this appetite for cash alternative payments and the growing conversion from cash to card and digital payments has been met by businesses. In the UK, a situation where card payments are unavailable occurs much less frequently than in other countries. A third of British people couldn’t think of any situation where paying by card was unavailable.

Our findings point to a consumer base still prepared to make purchases provided they offer value, despite global financial uncertainties and the cost of living crisis. It also confirms the UK as being advanced in their appetite for cash alternative payment options with businesses supporting their payment choices with a variety of options.