17 Jan UK’s 2021 Payment Trends reflect how 2020’s Transaction Habits has Left Lasting Change on Consumer and Merchants

The disruptive impact of the coronavirus pandemic’s emergence in 2020 on how communities function and businesses operate was immediate and unparalleled by any event in living memory.

While lockdowns and restrictions remained present in most countries through parts of 2021, semblance of normal life returned and gave the first signs of what societal changes, which had either emerged or been accelerated by Covid-19, would remain a mainstay in our everyday lives.

The rapid progress and marked utilisation of card, contactless and digital payment options was initially driven by the pandemic in 2020, with cash being deemed a perceived risk and the WHO encouraging shoppers to use contactless digital payments to limit the spread of the virus.

Yet, despite the declining impact of Covid-19 on everyday life in 2021, there were clear indications from consumer behaviour that the benefits and ease of cashless transactions had secured its permanence as a preferred payment option last year and was not just a temporary pandemic response.

This discernible change in behaviour by consumers and companies meant cash payments remained an industry outlier in 2021 with cashless payment options moving from accelerated growth in 2020 to consolidated preference in 2021.

Consumers continued to see benefits of contactless and digital payment options

Visa’s Back to Business Study had highlighted in 2020 how consumers placed “COVID-19 safety measures at the top of their shopping lists and rewarding businesses that do the same.” Globally, the report noted that contactless payments were a driving differentiator with almost two thirds of consumers surveyed claiming they would switch to a new business that installed contactless payment options with 78% of consumers changing the way they pay due to safety concerns.

In 2021, the popularity of cashless payment options continued to dominate as the industry norm with perceived ease of use and its benefits becoming the key driver rather than health concerns in a post-pandemic world.

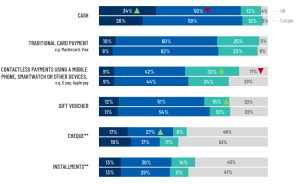

Our research on Covid-19’s Impact on Payment Behaviours in European Countries last year, found that, when shopping in person, a third of UK consumers surveyed would use cash less often than before the pandemic and 1/3 of British people – more than in all tested countries – plan to use modern contactless payments more often than before the pandemic.

![]()

Cardholders in the UK spent £69.1 billion on transactions last September according to UK Finance’s latest report, 15% per cent higher than the same period in 2019 – when shops were fully operating without restrictions. Contactless payments accounted for over half of credit card and almost 70% of debit card transactions.

The increase of the contactless limit on physical cards to £100 pound last year helped galvanise the popularity of their use with consumers and businesses, along with consumers’ growing familiarity with Google and Apple Pay ‘card-free’ contactless payments, moving physical cards into a digital wallet on our phones, watches or tablets. The ease and simplicity of online person to person payments, with apps like Revolut and Monzo, has continued to further our journey away from traditional cash scenarios too. This accustomed use of card and digital wallets use translated to online shopping transactions too.

“It seems that in the United Kingdom usage of traditional card payment and virtual wallet while shopping online will still the be most popular payment methods. The popularity of these payment methods may grow faster than in other European countries.”

EVO Payments Covid-19’s Impact on Payment Behaviours in European Countries

It is also worth noting that a cashless first approach has been maintained across all age demographics and not just younger age cohorts with 93% of over 65s, a group often defined as being more cash traditional, say they now use contactless payments in stores with debit and credit cards.

New payment options embraced by merchants and issuers

The growing number of payment options offered to customers in 2021 reflected businesses and the financial technology sector’s ability to adapt to new normal expectations.

Evidently, the seamless switch from cash to digital transactions has raised customer expectations of payment options from businesses of all sizes, with the preference from customers to favour businesses with card and contactless facilities noted by Visa the previous year remaining prevalent in 2021 with card/cashless payment methods proving especially important in all sectors.

British people believed that the possibility of card/cashless payments means that business is customer-centric and is keeping pace with current technology. This perception is similar regardless of industry as evidenced in EVO’s European research last year.

With many businesses reopening fully for the first time in 2021, we saw how sectors adapted effectively by choosing from the multitude of tailored options to support their business with, for example, sole traders like taxi drivers and tradespeople utilising mobile payment acceptance devices and larger retail outlets with integrated and omni-channel payment solutions merging in-store and online connectivity.

Sector-specific digital payment software has also played a part in streamlining and optimising transactional journeys for businesses and their customers, from, for example, appointment scheduling through to billing.

We will continue to see these responses to consumers’ needs and expectation too, with KPMG’s research into a digital future noting how organisations are accelerating digitisation to create seamless digital customer experiences, develop additional channels to reach and serve customers, and adapt to changing market conditions.

“Customers have clearly adapted to new, seamless digital interactions and business models and expect these to continue to improve, enabling an orchestrated and consistent customer experience: from browsing and purchase through to delivery, then payment and service.”

Forrester Consulting on behalf of KPMG, 2021

Cybercrime increase sparks business and industry reaction

The rise and consolidation of card, contactless and digital payments has also been met with an increase in cybercrime over the past 12 months. UK Finance’s half year report confirmed that in the first half of 2021, criminals stole a total of £753.9 million through fraud, an increase of over a quarter (30 per cent) compared to H1 2020.

The impacts of online fraud to any company’s finances and reputation with a third of consumers surveyed by Visa last year admitting they’d stopped shopping at a store or with a brand due to a fraudulent charge appearing in their account.

The acknowledgment and response to the growth of cybercrime has been strong. PwC’s survey on cyber security found that 50% of UK organisations agree that cyber security will now be baked into every business decision. The finance and banking industry continued to respond to it with advanced security systems used by banks preventing a further £736 million from being taken.

The planned rollout of PSD2 SCA this year, a robust solution that offers greater security by ensuring that electronic payments are performed with multi-factor authentication will also impact the prevalence of cybercrime.

Like with all new technology, it will take time for cardholders to become familiar with it. However, over time 3DS2 is expected to increase consumer confidence in buying on-line and reduce fraud with increased consumer confidence in an e-Commerce environment

This consolidation of card, contactless and digital payments preference in the UK, as well as the industry’s response to online fraud, has set the foundation for the financial services industry to continue to support fluid and exceptional customer experience with more exciting trends to come in 2022.