01 Feb EVO Payments UK Trends and Predictions for 2022

It has been almost 2 years since concerns over cash’s potential to spread virus and disease emanated to the forefront of consumer and business owners’ minds, as rumours of a highly-contagious novel coronavirus began to feature more prominently in the UK media.

Flash-forward to today’s reality and the majority of consumers and merchants have found their feet with card, contactless and digital payments after an accelerated step-change away from notes and coins in 2020.

Last year’s payment trends reflected the growing acknowledgement of cashless transactions’ benefits for customers and the quantum leap towards card and digital transactions will not be reversed.

The popularity of cash had already been on the wane pre-pandemic but the expected new era of universal payment acceptance unattached to physical money arrived more hurriedly as a reaction to unprecedented events rather than a more gradual assimilation over this decade as previously anticipated.

Cards surpassed cash as preferred payment method only recently and, now, they too are challenged by digital wallets and apps. This change is predicted to continue in 2022 given the frictionless ease, speed of purchasing and security of paying with wearable devices and digital cards.

We look at what other changes and developments will affect businesses in the card payment space this year.

Convergence of on and offline channels

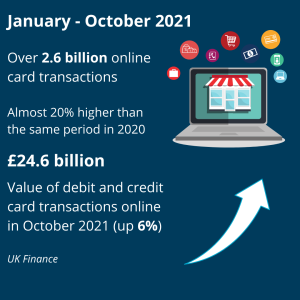

Over the past 24 months sole traders and companies have either developed or evolved their digital presence to match customer expectations and shopping habits. Increased adoption of payment gateways, virtual terminals, use of social commerce on social media platforms and pay by link payment options have accommodated heightened accessibility to brands, products and services.

shopping habits. Increased adoption of payment gateways, virtual terminals, use of social commerce on social media platforms and pay by link payment options have accommodated heightened accessibility to brands, products and services.

Recent data has reflected that customers will want over half of pandemic-era services to become the new normal this year. This and, the rise of more digital-first shoppers, leaves a large question mark over the role of physical stores and the high street retail in 2022.

Geoff Barraclough, Head of Proposition at EVO Payments Europe, predicts how shops may need to change their in-store approach to address the continued growth in online shopping. Retailers must reassess the customer journey as it now incorporates both in-person and digital decision touchpoints, with physical shops laying foundations for customers to complete potential transactions online or, visa-versa, digital engagement leading to an in-store purchase.

Barraclough predicts that, “we could see retail stores refocusing on customer experience and showcasing their products with clear signposting on how to continue customer engagement with their brand online.”

Connecting both commerce environments to support customer needs will be key with stores playing a more pivotal role as marketing and inventory fulfilment channels and savvy business owners are ready to adapt.

Live shopping from your home and digital bricks build the physical shopping experience

Live shopping and virtual consultation – utilising online livestream broadcast to allow viewers to watch, engage and shop at the same time – is the

next eCommerce step for retailers in merging their physical environment to a digital audience, particularly for the Generation Z demographic and Millennials, while also opening up opportunities for visitors from a worldwide audience to visit a store.

next eCommerce step for retailers in merging their physical environment to a digital audience, particularly for the Generation Z demographic and Millennials, while also opening up opportunities for visitors from a worldwide audience to visit a store.

Conversely, we will see more shops incorporate digital components with “digital bricks” scaffolding the in-store shopping experience. Research has indicated that 89% of customers are interested in using more technology in-store. Interactive screens and digital shop windows will play a bigger part in catching consumer attention on the high street.

“Retailers need to think about their physical and their online presence as one, rather than as two separate entities,” notes Kate Orwin, the leasing director at shopping centre operator, Unibail-Rodamco-Westfield. “The line between the two is increasingly blurred in the minds of the end consumer.”

Potential of ISV’s with integrated payment functionality continues to be achieved with sector specific solutions

The value of Independent Software Vendors (ISV’s) with integrated payment solutions is clear, offering quick, efficient and seamless user experience to both customers and merchants as the sales and business process are merged and payments are instantly reconciled.

ISV’s concentration on specific and niche markets has been borne out of opportunity as well as necessity with attempts to develop effective generic retail software having little impact given the complexities of product merchandising hierarchy, notes Barraclough.

The benefits of being sector specific – with highly customized software for everything from golf courses, to convenience stores to florists and hairdressers – has furthered business owners’ transition to technology-focused ISV software to support their business in-store and online.

Payment technology sharpening business focus

These enhancements in payment-integrated technology has also armed businesses with strong data and insights to build from in 2022.

“Merchants, who in the past would have to do tasks like stock control, accounting or loyalty programmes manually, now have access to systems which will help them track inventory, deliver customer insights and run loyalty programmes at the click of a button.”

Visa – Future of Payments

Payment provider partnerships with ISV’s, that can best support the digital ambitions of your business will play a leading role in supporting you inform business strategy and expectation with cutting-edge, backend technology.

“It’s hard to track and quantify how many people might come into your shop and maybe leave the queue or where they decide not to complete a purchase,” Barraclough points out. “You can see this online with more webpage metrics and the likes of cart abandonment and bounce rates.”

With this growing understanding of customer insights and data, driven by better payment solutions, it’s becoming easier to decide key decisions on potential consumer journey barriers, products, pricing and promotions for business with a clearer picture of which customers to engage with, when to engage and what to offer.

The demand from merchants is already there for more than point of sale technologies and in 2022 partners and payment service providers will continue to demonstrate added value to businesses with solutions covering multi-channel usage, security, and specific industry and regulatory requirements.

Changes to regulation for payment schemes and tackling fraud

We can expect to see the regulatory spotlight shine brightly on unregulated payment schemes like Buy Now Pay Later (BNPL).

While they are currently unregulated in the UK, benefiting from an exemption for short-term credit-free credits, the UK Treasury has recently closed a 3 month public consultation on BNLP and could decide to regulate by delegating responsibility to the Financial Conduct Authority (FCA) to develop rules around it.

Consumer groups and bodies urged the UK not to follow Australia’s in allowing BNPL industry to regulate itself and instead to “take steps to ensure these products have better safeguards, in a manner that puts consumers, particularly people experiencing vulnerability, first,”

Which? have similar concerns and called on BNPL firms to make their terms and conditions more accessible, adding that affordability assessments should be carried out for all transactions before regulation is introduced.

Industry response to cybercrime

Increased familiarity with the digital payments landscape over an accelerated period of time has been exploited by an increase in cybercrime. The banking and financial services sector have continued to tackle and limit incidences of online fraud with the Banking Protocol, a UK-wide scheme launched by UK Finance, National Trading Standards and local police forces having continued success.

Increased familiarity with the digital payments landscape over an accelerated period of time has been exploited by an increase in cybercrime. The banking and financial services sector have continued to tackle and limit incidences of online fraud with the Banking Protocol, a UK-wide scheme launched by UK Finance, National Trading Standards and local police forces having continued success.

There is every reason that, although challenging, continued industry response and growing security awareness will continue to thwart hackers efforts to exploit consumer and business’ finances.

Barraclough reflects on the positive impact mandating Strong Customer Authentification (SCA) has and will have.

SCA ensures that electronic payments are performed with multi-factor authentication, to increase the security of electronic payments.

One business concern with SCA will be that, although expected to become less of an obstacle once users become more familiar with its purpose and process, the frictionless experience depends on the issuing bank’s ability to operate an unhindering authentication process.

This varies with some still issuing one-time pass codes and could lead to increased cart abandonment.