22 Oct ISV Integration options and the importance of payment partnerships

ISV’s have been at the cold front of the digital experience heightening both consumer and merchant acceptance of software solutions that improve checkout experiences, create operational efficiencies and improve financial earnings and savings.

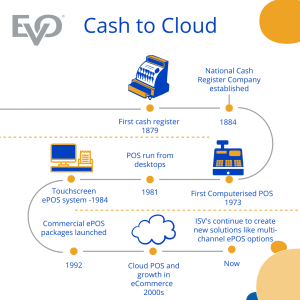

The solution-driven nature of ISV’s remains the same today as it did in the 1870s, when the first cash register was invented by a saloon owner in Ohio, allowing users to record transactions to support better bookkeeping and management of capital.

The advent of the internet and growth in eCommerce popularity, has enabled merchants to process digital payments across a number of platforms, consolidate all payments with comprehensive payment reports and utilize payment data for planning, forecasting and a host of other business supporting purposes.

EVO Payments has been part of this changing payments paradigm for well over three decades, evolving from an ISO to a holistic payment solutions provider building dynamic partnerships to support future-proof payment solutions for businesses in over 50 markets and 150+ currencies.

As a global market leader with its success founded on building and nurturing strategic relationships we have more scope than most in terms of what integrated payment options are available and what makes long-lasting ISV partnerships.

Integrated payment options

With merchants expecting seamless and quick in-person transactions and merchants searching for payment options that reduces delays, mobile point of sales (mPOS) transform tablets and smartphones into digital terminals and allows staff to complete transactions on the spot without needing to go to and from a standalone ePOS machine. The payment solution reduces queuing and gives businesses more time to offer customers more value added service.

Similarly, pay at table has the capacity to make the customer experience at restaurants and bars more convenient by enabling them to send their food order to the kitchen or bar and pay without staff assistance. Unattended payment points like kiosks in stores to order and pay, particularly at food outlets, has helped automate the transaction process at a time when businesses are facing staff shortages. These unattended transaction technologies have also proved popular on vending machines and at toll booths.

QR codes have regained popularity with 87% of European smartphone users scanning a QR Code at least once in their lifetime and 36% scan at least one QR Code a week and the opportunity to complete payments in apps allows consumers pay quickly and conveniently for goods and services via their smartphones for online purchases or pay and collect in-store.

The continued rise of online shopping, consumers’ growing use of mobile wallets and the P2SD2 directive enabling better shopping experiences on mobile devices has allowed integrators better platform for creating payment solutions suitable for mCommerce with live shopping, social commerce and VR beckoning an new wave of payment integration opportunities.

Growing role of ISV and payments partnership engagement models

With over a decade’s experience in the payments industry, EVO Payments’ Sales Director, Peter Brook has seen how these new innovations have transformed expectations around payments in the UK.

Given the complexity of these tech-enabled point of sale ecosystems and the growing number of competing ePOS and eCommerce options now available, he has recognised the growing number of ISV business owners seeking payment partners willing to collaborate, with vendors investing more time and research to ensure alignment with experienced partners demonstrating similar ambitions and capabilities.

“The ISV industry is striving* but ISV and payment provider partnerships must share a growth mind-set to work. Vendors and fintechs must work with each other to provide a reliable and differentiated solution for merchants. It must go beyond offering just payment solutions,” notes Brook.

“From development support to sales and marketing campaigns with our partners, EVO has seen the benefits of this approach, with our marketing toolkit and partner accelerator program giving partners the best possible platform to scale responsibly.”

ISV’s need current and future seamless integration and flexibility

In the same way customers now expect seamless and frictionless payment journeys, the same is true for ISV business owners and their clients. Agile integration for both current and future solutions means ISV’s are partnering with experienced payment provider with integration plans and procedures in place to support ISV’s both offer card payment acceptance functionality to merchants on all payment touchpoints.

“With ISV business owners busy evolving the development of their own technology, it’s important they know they are backed by a provider who can support both updates to their software and new solutions with seamless integration.”

What started out as a basic record-keeping and cash management device – in a long since closed tavern – continues to evolve. Meaningful payment provider and ISV partnerships ensures the next wave of payment innovations stays true to that solution-based approach which point of sale and eCommerce systems are now expected to be.

EVO Payments UK – Trusted Payments Partner

EVO Payments continually strives to be at the forefront of the payments industry. By focusing on the development and delivery of innovative, best-in-class payment processing solutions, we are more than an acquirer or a processor – we are a technology partner too.

EVO Payments’ partner program will give you an on-going source of revenue whilst helping you to create a solution with real USPs to differentiate you and your products in the UK market.

Reach out to talk with us today