13 Apr Chargebacks: What they are, how they occur and how to avoid them.

Chargebacks, the reversal of a money transfer to a payer’s (most commonly a consumer) account by the issuing bank when a transaction is successfully disputed, have increased in recent years with the accelerated rise in card and online payments.

While chargebacks are necessary in consolidating consumer confidence in card and online purchases, particularly in today’s world where businesses are more reliant than ever on accepting cashless transactions, chargeback disputes can cause understandable stress on business owners given the resource and time required to dispute a claim, as well as the financial impact they can have.

Prevention of chargebacks is a lot more cost effective than disputing them. We analyse how the process works, how chargeback can occur (and how to limit their occurrence) and how to avoid them.

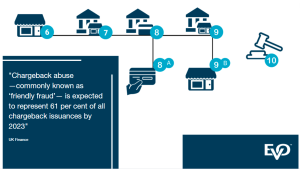

Who’s involved in a chargeback dispute and how does it work?

The Main Players

Cardholder

The person who made the initial purchase (Unless they are a victim of card theft)

Merchant

The business who sold the product or service to the cardholder

Issuer

The cardholder’s bank / financial institution

Acquirer

The merchant’s card processor

Card Scheme

The association that owns the card brand (Mastercard, Visa etc.)

Court of Arbitration

The main body responsible for making the final decision if a dispute can’t be resolved by previously mentioned actors

*The acquirer and issuer can be the same bank/ financial institution depending on the circumstances.

The Chargeback Dispute Process

Initiation of a chargeback claim

- Cardholder initiates a chargeback claim by contacting their issuing bank/ financial institution (issuer).

- The issuer must verify the chargeback claim and then forwards the claim to the card scheme.

- The card scheme sends the claim to the acquiring bank/ financial institution (acquirer)

- Acquirer considers the evidence from the claim and forwards the claim to the merchant.

- The disputed payment is returned to the cardholder and the merchant can either accept or dispute the cardholder’s chargeback claim.

Dispute of a chargeback claim

- Merchant forwards representment (submitting evidence to the bank proving that a transaction was valid) to the acquirer.

- The acquirer then forwards the merchants claim to the issuer.

- Either the issuer can accept the merchant’s evidence and reject the cardholder’s claim (8a) or they side with the cardholder and reject the merchant’s argument, requesting the acquirer to initiate the chargeback and reverse the money transfer from the merchant to the cardholder (9).

- If the acquirer agrees with the issuer, it will inform the merchant (9b) and, if the merchant accepts the decision, the issuer debits money from the merchant’s account, transfer it to the issuing bank, who credits it to the customer’s card account.

- The cardholder (8a), merchant (9a) and acquirer (9) may or may not agree with the decision. The arbitration commission of the payment system will then conduct its own investigation and make the final chargeback decision. (Note: This process involves a fee from the initiator)

When can chargebacks happen?

Third Party Criminal Activity

This can occur when criminals use stolen credit card numbers to purchase goods and services fraudulently. In the vast majority of Card Not Present transactions (e.g. Over the phone payments), the merchant is liable for the transaction.

“Friendly” Fraud

Friendly fraud differs from regular fraud as it happens by the cardholder or someone with legitimate access to the cardholder’s account and not a third party. This can be accidental and without fraudulent intent.

Friendly fraud differs from regular fraud as it happens by the cardholder or someone with legitimate access to the cardholder’s account and not a third party. This can be accidental and without fraudulent intent.

Cardholders might mistakenly dispute charges they made because they forgot they made the purchase or they don’t recognize the business listed on their card statement due to a different business name appearing. Also, family members linked to an account might make purchases unknown to the primary cardholder, who then initiates a chargeback request.

However, friendly fraud isn’t always accidental. Cardholders may dispute a purchase because they have buyer’s regret. They could also be trying to con the system and profit from a transaction, gaining both a product/ service as well as chargeback.

Merchant Fraud or Merchant Error

Merchants can be deliberately or accidentally liable in a chargeback dispute depending on the circumstances.

Merchant Fraud

The most straightforward examples of a business taking advantage of a transaction involves:

- Deliberately failing to ship a product or provide a service after payment has been accepted.

- Selling a product as authentic but delivering a fake or damaged product on purpose.

- Charging a higher price or unexpected additional fees/ charges than the customer had agreed to or expected.

In these instances, a business will be found liable in a chargeback dispute and the merchant may also incur penalties, fines and additional fees.

Merchant error

Chargeback disputes occurring from merchant error can be difficult for a business to accept, so it’s important to know how they may occur:

- Customers receiving defective merchandise by accident- which may have become damaged in transit after the merchant has shipped it.

- The overselling of a product or service’s description by the business owner, staff or online description as the consumer may feel misled if the specifications fail to match their expectations.

- Unclear subscriptions and cancellation policies with a product or service.

- Difficulty and inability for a customer to engage with a business over issues they have with the product or service they’ve purchased. This can lead to the cardholder issuing a chargeback claim as they may feel it’s their only route to receiving a refund.

How can you avoid merchant error and friendly fraud chargeback disputes?

Use accurate descriptions on products/ services and on credit and debit card charges

Whether selling in-person or online, clear and accurate descriptions of product and services can alleviate the possibility of chargebacks. This is also true for a business’ name on a customer’s bank statement to avoid confusion.

Clearly state the price and final cost to the customer

It’s important all charges and fees are included in the price to your customers, or that the pricing clearly states it excludes VAT if it does so. By doing so, customers are fully aware of what they will be charged before making any purchases.

Shipping policies

Clear engagement around shipping times, while also ensuring there is no delay from the business when posting a product to a customer, will limit chargeback opportunities

Refund policies and clear engagement

Offering a refund, where applicable, is less costly and stressful than being involved in a chargeback case. By clearly signposting how and why a customer may request a refund, as well as having open channels of communication for customers to follow up with, will limit the necessity for chargebacks.

How can merchants protect themselves from chargebacks relating to criminal fraud by third parties?

Card Not Present transactions pose a major fraudulent risk to business owners as they are taken at the merchant’s own risk and their business is financially liable for fraudulent transactions.

Caution with multiple, bulk orders or high-value orders

Watch out for customers buying lots of the same item, either in the same transaction or separately. Orders larger than normal may indicate fraud. High-value items such as jewellery or electrical goods are often targeted by fraudsters because they are easy to resell, so take extra care with this type of transaction.

First-time customers who place multiple orders or sales that are too easy to be true

The risk of fraud is smaller when dealing with customers you know. Be suspicious if a customer is not interested in the price and/or detailed description of the goods, but is only interested in delivery times.

Customer and card discrepancies

Be cautious if a customer’s uncertain about personal information, such as their postcode or spelling of their street name or if a difference person to the cardholder collects the goods.

- Transactions on several cards where the billing address matches but different/various shipping addresses.

- Multiple transactions on a single card over a very short period of time.

- Multiple cards beginning with the same first six digits offered immediately after the previous cards are declined.

- Customer offering multiple different cards one after another without hesitation when previous cards are declined.

- Orders shipped to a single address but purchased with various cards.

What steps can you take when you are involved in a chargeback dispute?

Be prepared and record transactions

Depending on your business type and structure, and the nature of the purchase being disputed, all or some of the below examples will equip you with relevant evidence to defend a chargeback claim from a cardholder.

- Proof of customer purchase and history of customer transactions

- Confirmation of delivery confirmation or any evidence the customer received the product or service)

- Copy of the refund or return policy agreed to by the customer

- AVS (address verification system) and CVV (card verification value) matches

- IP address of customer’s purchase device for online transactions, along with exact time and date of purchase

- Geographic location of the device

- Any correspondence, with the cardholder or their representatives – emails, phone records or letters/ records documenting conversations with the customer.

Follow the timeframes and deadlines

Being aware of the timeframes and deadlines and following them is key to implementation a success appeal to a chargeback case.

Once the cardholder has made a chargeback request, it’s important to note the timelines set out by the acquirer for responding to the initial notification and submitting supporting documents to defend the chargeback claim.

Engage with the acquirer and submit evidence and all other requested documentation to them on time.

Engaging fully with the acquirer improves your chances of successfully defending your business against an illegitimate claim. This will help the acquirer create a more-informed picture of the situation.

Responding to the decision

By keeping and submitting relevant records and engaging fully with the process, an illegitimate chargeback claim should hopefully be appealed successfully. If you are unsuccessful, you can still appeal to arbitration but, as mentioned, this can cost up to $500 and may take some time for a final decision to be made.\

The impacts of chargeback on a business, whether successfully or unsuccessfully disputed, can cause stress and create a strain on resources, as well as having a telling financial impact. By being informed on what they are and how they may potentially occur, can protect you from becoming involved in a chargeback dispute and, if you are unfairly targeted in a chargeback claim, being prepared will support you through the described process.

The impacts of chargeback on a business, whether successfully or unsuccessfully disputed, can cause stress and create a strain on resources, as well as having a telling financial impact. By being informed on what they are and how they may potentially occur, can protect you from becoming involved in a chargeback dispute and, if you are unfairly targeted in a chargeback claim, being prepared will support you through the described process.